Boost Your Competence with Bagley Risk Management

Boost Your Competence with Bagley Risk Management

Blog Article

Exactly How Livestock Risk Security (LRP) Insurance Coverage Can Protect Your Livestock Financial Investment

In the realm of animals financial investments, mitigating threats is paramount to ensuring economic security and growth. Livestock Risk Security (LRP) insurance coverage stands as a dependable guard against the unpredictable nature of the market, using a strategic strategy to safeguarding your properties. By delving right into the complexities of LRP insurance and its diverse benefits, livestock manufacturers can strengthen their financial investments with a layer of safety that goes beyond market fluctuations. As we check out the world of LRP insurance coverage, its duty in safeguarding livestock investments becomes progressively obvious, assuring a path towards sustainable monetary durability in a volatile market.

Comprehending Livestock Danger Security (LRP) Insurance Policy

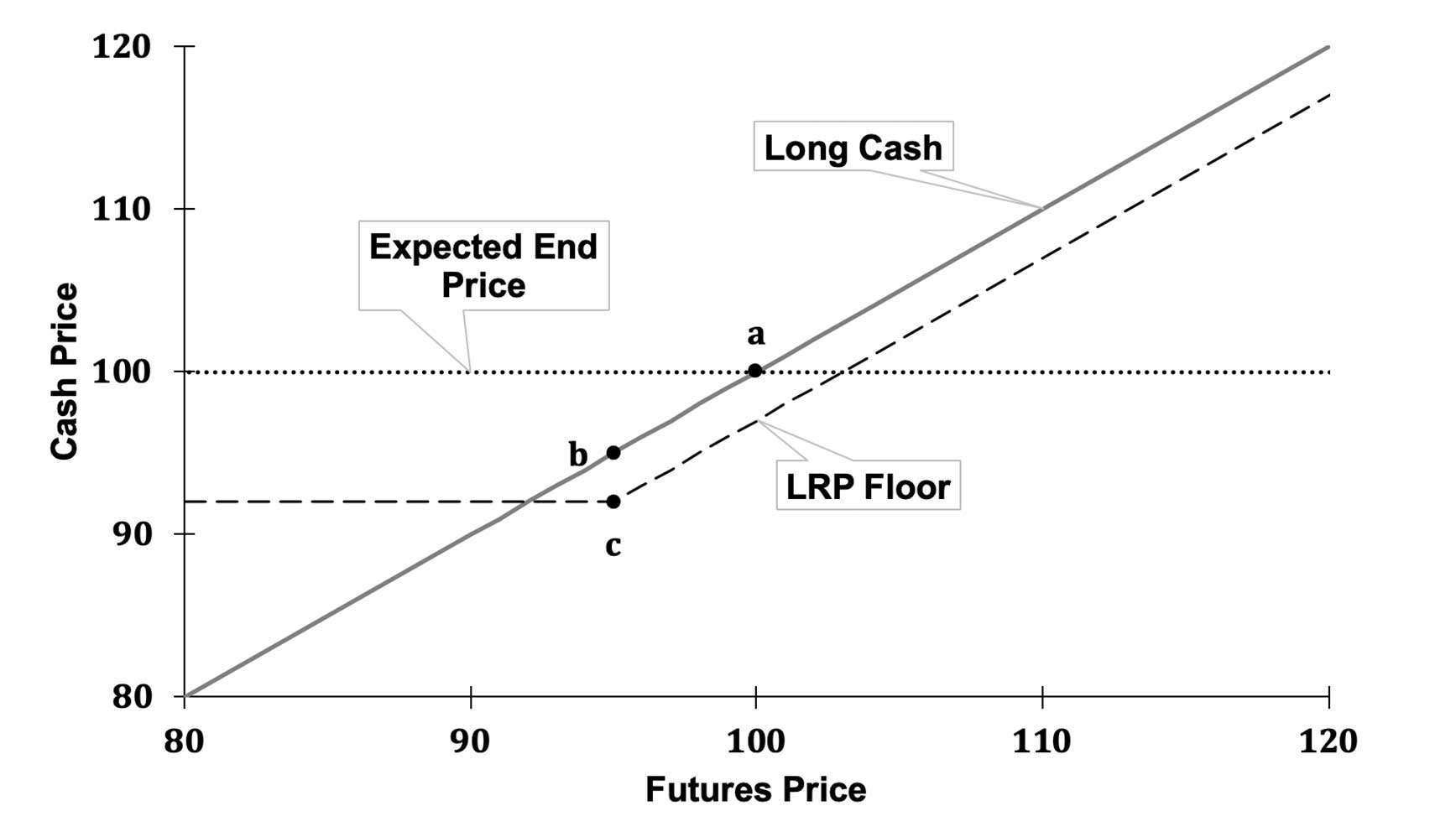

Understanding Livestock Threat Protection (LRP) Insurance coverage is crucial for animals manufacturers wanting to mitigate economic risks connected with cost fluctuations. LRP is a federally subsidized insurance product designed to secure manufacturers versus a decrease in market prices. By providing protection for market price decreases, LRP aids manufacturers secure in a flooring rate for their animals, ensuring a minimal level of income no matter of market changes.

One trick aspect of LRP is its adaptability, enabling manufacturers to customize protection levels and policy sizes to match their specific requirements. Manufacturers can choose the number of head, weight range, insurance coverage price, and insurance coverage period that straighten with their manufacturing goals and run the risk of tolerance. Understanding these personalized choices is important for producers to effectively handle their cost danger exposure.

In Addition, LRP is offered for various livestock kinds, consisting of livestock, swine, and lamb, making it a flexible danger monitoring tool for animals manufacturers throughout various fields. Bagley Risk Management. By acquainting themselves with the complexities of LRP, producers can make informed choices to safeguard their financial investments and make certain monetary stability despite market unpredictabilities

Benefits of LRP Insurance for Livestock Producers

Livestock producers leveraging Animals Risk Defense (LRP) Insurance coverage obtain a calculated advantage in shielding their financial investments from rate volatility and securing a secure monetary footing in the middle of market unpredictabilities. By setting a floor on the price of their livestock, manufacturers can alleviate the threat of substantial economic losses in the event of market slumps.

In Addition, LRP Insurance gives manufacturers with assurance. Knowing that their financial investments are guarded versus unexpected market modifications enables producers to focus on other elements of their organization, such as improving animal health and welfare or optimizing production processes. This peace of mind can bring about raised performance and earnings in the future, as producers can run with even more self-confidence and security. On the whole, the advantages of LRP Insurance for livestock producers are considerable, using a useful tool for taking care of risk and making certain economic safety and security in an unpredictable market atmosphere.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Reducing market risks, Animals Danger Defense (LRP) Insurance coverage offers livestock producers with a dependable guard against cost volatility and financial unpredictabilities. By offering defense against unexpected price declines, LRP Insurance policy assists producers safeguard their investments and preserve economic security despite market fluctuations. This sort of insurance policy enables livestock manufacturers to secure in a price for their navigate here animals at the start of the policy duration, guaranteeing a minimal rate level no matter of market changes.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of agricultural danger monitoring, executing Livestock Threat Defense (LRP) Insurance includes a critical process to guard investments against market changes and unpredictabilities. To safeguard your animals investment effectively with LRP, the very first action is to examine the details risks your operation faces, such as price volatility or unforeseen weather condition occasions. Next off, it is essential to research study and choose a reputable insurance service provider that provides LRP policies tailored to your livestock and company needs.

Long-Term Financial Safety And Security With LRP Insurance

Ensuring sustaining economic security with the usage of Livestock Risk Protection (LRP) Insurance policy is a sensible lasting technique for farming manufacturers. By integrating LRP Insurance coverage into their threat management strategies, farmers can guard their livestock financial investments versus unpredicted market changes and negative occasions that might threaten their economic wellness over time.

One trick benefit of LRP Insurance coverage for lasting economic safety is the assurance it supplies. With a reputable insurance plan in location, farmers can alleviate the economic risks related to unstable market problems and unanticipated losses due to aspects such as disease break outs or natural disasters - Bagley Risk Management. This stability enables manufacturers to focus on the daily operations of their livestock service without consistent fret about prospective financial setbacks

In Addition, LRP Insurance coverage gives an organized strategy to handling risk over the long-term. By establishing certain protection levels and selecting proper endorsement periods, farmers can tailor their insurance prepares to align with their economic goals and run the risk of tolerance, ensuring a secure and sustainable future for their animals procedures. Finally, investing in LRP Insurance is an aggressive method for agricultural manufacturers to accomplish long lasting financial security and protect their incomes.

Final Thought

To conclude, Animals Danger Defense (LRP) Insurance policy is a useful tool for animals producers to mitigate market dangers and you can find out more protect their investments. By understanding the advantages of LRP insurance and taking actions to implement it, manufacturers can accomplish long-lasting economic safety for their procedures. LRP insurance offers a safeguard against cost changes and makes sure a level of stability in an unforeseeable market setting. It is a sensible selection for safeguarding animals financial investments.

Report this page